|

| Faisal Galaria: 'The digitisation of books should not be seen as a threat for publishers, rather a new way forward. |

To start, picture the current publishing landscape as a sort of post-apocalyptic publishing scene; where old publishing models and formats have been devastated by some dastardly digital interruptive menace.

Things are in disarray - and although old forms are still commanding majority bucks - the old form tail is slowly eating its own head and the incoming bucks, while not diminishing rapidly, have flattened and steadily losing growth.

Meanwhile, over in the digital camp, their new form champion is pulling record increases in rates of unit sales. Increasing to the point where digital books represent 10 to 20 percent of total book sales (depending on the data source).

Now, let's bring in a little reminder of what happened to the music industry when it went digital. In the name of convenience, aggregation and immediacy Napster, iTunes and Torrents blew up the inner core of the music industry and the iPod finally caused the decline of the CD business. But, after a long period of revenue losses, the music industry eventually figured out just how to properly price and source the new streaming music format that would provide an unlimited source of music for a subscription fee. This injected growth back into the music industry (e.g. Subscription and ad-supported streaming services accounted for $1.2bn of the global music industry revenues in 2012, up from $700m in 2011).

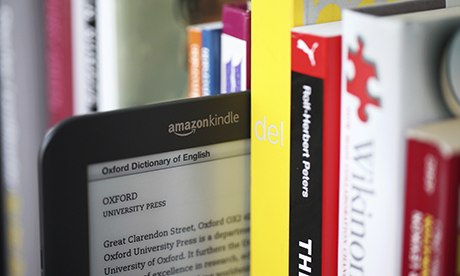

The publishing industry's equivalent to the music industry's Napster, iTunes and iPod are the tablets and e-readers. These will eventually do the same to the publishing industry as the iPod did to the music industry, providing readers with aggregation, convenience, social discovery and immediacy.

There are signs that the way in which books are consumed could be going the same way; that is, in a convenient streaming format available to the consumer for a subscription fee.

'Scribd, Oyster and 24Symbols are all services that provide access to ebooks in return for a monthly payment, much in the same way that music and film streaming services operate.'

More details provided in The Guardian by Faisal Galaria, senior director at Alvarez & Marsal:

Publishing crisis? Time to create a Spotify for books

Publishers must learn the lessons from music streaming services around pricing and sourcing for their subscription models to work

Dark clouds appear to be looming over the publishing industry. Figures released last week by accountants Wilkins Kennedy revealed that 98 UK publishers went bust over the last year, a rise of 42% on the previous year. Though this figure is stark, there's evidence elsewhere to believe that all is not necessarily lost for the publishing industry.

While print sales of books stayed fairly static in 2012, falling just 1% to £2.9bn, the real success story was the ebook, rising 134% to £216m,according to the UK Publishers Association. The huge rise can be explained by a low base, but the reality is that ebooks now represent nearly 10% of book publishers' total sales.

Publishers have been hit by the rise of the second-hand book market, but the fact that print sales have remained steady shows the opportunity in the sector. Along with the rise in ebooks, the signs actually look positive.

Not everyone has taken to ebooks. They don't feel the same as books, nor do they look like books. Essentially, to some people, they simply do not provide the same satisfaction as a printed volume.

There are parallels with the music industry, where a similar argument was made for vinyl rather than the compact discs which followed in the 1980s. And it could actually be argued that the critics had more of a point - vinyl was widely accepted to be of much better quality than its successors.

But that didn't stop the rise of digital music.

Indeed there are lessons to be learned from the disruption witnessed in the music industry. Napster, iTunes and torrents all shook the inner core of the music industry, but it was eventually the iPod that caused the decline of the CD business.